Franking Account Worksheet 2016

To add entries to the worksheet click CtrlInsert. During 201617 the directors of Star paid out the after-tax profits of 56 million.

Interest On No Tfn Tax Offset Worksheet Ito Ps Help Tax Australia 2018 Myob Help Centre

Franked dividend paid by FQ Pty Ltd on 15 November 2016 Franking Account debit 7000001-tax ratetax rate Franking account balance 30 June 2017.

Franking account worksheet 2016. Fully franked dividend income. 28112016 1 Division 7A Debit Loans Status Quo Peter C Adams Introduction Division 7A of Part III of the Income Tax Assessment Act 1936 ss 109B to 109ZE operates to treat certain transactions by private companies on or after 4 December 1997 to be the payment of an unfranked dividend by that company. Maximum franking credit.

This is also the date. Each entity that is or has ever been a corporate tax entity has a franking account. Care needs to be taken not to over-frank by allocating more franking credits than are in the franking account when paying dividends.

700000 300000 0. 700000 265517 965517. The total over-franking amount integrates to Section B Label D in the Franking Account Tax Return.

Franking account balance worksheet Capital Allowances UCA LVP SBE worksheet As mentioned in our previous blog youll be able to access our Tax features through the new Practice Manager as theyre rolled out iteratively over the coming months. ANZ share price is 16 and they announce a fully franked 100 dividend of 120 per share. Accounting Job Sheet Checklist V1-01-11-04.

A x B x C C-1 Where. Provide calculation details to confirm figure put on tax return ie. 700000 300000 1000000.

Franking Accounts A franking account records the amount of tax paid that a franking entity can pass on to its membersshareholders as a franking credit. The maximum franking credit it can attach to that distribution based on the above formulas is calculated as follows. Wages plus super INSERT NAME OF FIRM.

A the franking differential percentage B the frankable distribution amount C the corporate tax rate. 625 X 16 10000. From 1 July 2016 further amendments to the corporate tax rate have been approved.

The Franking account tax return 2016 is for the period 1 July 2015 to 30 June 2016. Assuming corporate tax rate of 30. This represents the tax the company has already paid.

Freds assessable dividend for YE 30 June 2017 Add Franking credit on the dividend Total Taxable. Applicable gross up rate 100 275 275 26364. Accompanying the increase in the turnover test to 10m and the drop in the corporate tax rate to 275 for 201617 was a change to the imputation rules.

To determine the appropriate franking rate in a particular year the company will use its turnover in the previous year to determine the tax rate in the current year. 120 X 625 750. 700000 265517 34483.

Use standard worksheet Note SBE and PSI issues Franking Account. The 100 of company. His dividend statement says there is a franking credit of 300.

Each entity that is or has ever been a corporate tax entity has a franking account. Pederman Plastics wants to distribute 100000 profit to its shareholders. The aggregated turnover for the previous income year 201516 was 8 million.

The change to the imputation rules means a small business can no longer frank dividends at 30 and they will have to frank. This could result in your having to pay a franking deficit tax. Suppose you had 625 units of shares in ANZ.

Total cash dividend X 3070. Practice exam question tabl2751 semester 2016 past exam questions refer to information on moodle regarding more details on the semester 2016 exam. Tax on total 49.

A franking account records the amount of tax paid that a franking entity can pass on to its members as a franking credit. This worksheet calculates the over-franking tax using the formula. Use standard worksheet Payment to Associates.

N is an early balancing corporate tax entity. ATO imputes or allocates or assigns or credits the franking credit to each shareholder and reduces the companys franking account by the same amount. The franking account tax return must generally be lodged by the last day of the month following the end of the income year typically 31 July.

As 8 million is less than the 201617 threshold of 10 million an 8 million turnover would attract a. This means the dividend before company tax was deducted would have been 1000 700 300. What is the correct franking rate.

Complete the period boxes at the top of the return with the start of the period covered by this tax return to the end of the period if the entity. Come tax time James must declare 1000 the 700 dividend plus the 300 franking credit in his taxable income. From 1 July 2016 these changes aim to link the maximum franking rate to the corporate tax rate at which each company pays tax.

Client Engagement - Accounting Job Sheet and Checklist Page 1 of 11. Taxation of dividends at Shareholder level. An entity is considered a franking entity if it is a corporate tax entity.

Those transactions fall into three. When shareholders complete their tax returns they add the 70 of dividend to the 30 of franking to declare the 100 of taxable income in this form here.

Back To Basics Franking Accounts Credits Dividends Initiative Chartered Accountants Financial Advisers

Internet Scavenger Hunt Valentine S Day Internet Scavenger Hunt Computer Lab Lessons Scavenger Hunt

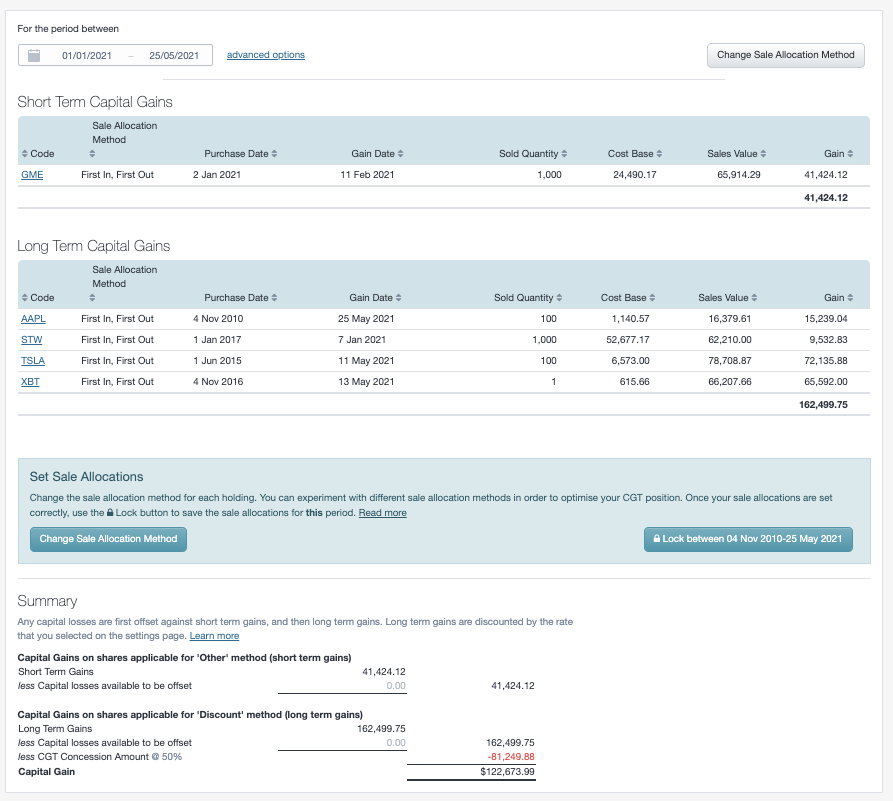

Capital Gains Tax Calculator For Australian Investors Sharesight

Distribution Item 51 Statement Of Distribution Ps Help Tax Australia 2018 Myob Help Centre

Ultimate Personal Planner Template For Excel Personal Planner Planner Template Daily Planner Template

Item 20 Foreign Source Income And Foreign Assets Or Property Ps Help Tax Australia 2020 Myob Help Centre

Early Stage Investor Tax Offset Worksheet Esi Trust Ps Help Tax Australia 2019 Myob Help Centre

Paygi Instalment Rate And Gdp Adjusted Calculations Ps Help Tax Australia 2018 Myob Help Centre

Motor Vehicle Worksheet Mve Ps Help Tax Australia 2019 Myob Help Centre

Https Www Myob Com Content Dam Public Website Docs A P Tax Seminars 2020 Myob 2020 Tax Seminar Workbook Pdf

Https Www Ato Gov Au Uploadedfiles Content Ind Downloads Franking Account Tax Return 2017 Pdf

Internet Scavenger Hunt Valentine S Day Internet Scavenger Hunt Computer Lab Lessons Scavenger Hunt

Https Www Myob Com Content Dam Public Website Docs A P Tax Seminars 2020 Myob 2020 Tax Eseminars Slides Notes Pdf

Https Www Myob Com Content Dam Public Website Docs A P Tax Seminars 2020 Myob 2020 Tax Seminar Workbook Pdf

Company Tax Return In Practice Manager Xero Blog

Early Stage Investor Tax Offset Worksheet Esi Trust Ps Help Tax Australia 2019 Myob Help Centre

How To Enter Dividend Income Including Franking Credits Unfranked Income Etc

Https Www Myob Com Content Dam Public Website Docs A P Tax Seminars 2020 Myob 2020 Tax Seminar Workbook Pdf

Https Www Myob Com Content Dam Public Website Docs A P Tax Seminars 2020 Myob 2020 Tax Seminar Workbook Pdf

0 comments :